An Inspiring Encounter at “Young Leaders Council AIMA Summit 2024! “@AnkurWarikoo”

#AIMAYLC2024 #Leadership #Inspiration #YoungLeaders

Digital Payments Without Digital Barriers.

- Faster Payments.

- Smoother Collections

- Instant Reconciliation

Market Share 20%

Industries We Work With

Our Product Stack

- Instant Onboarding. Verified Accounts. Zero Manual Effort.

- Faster KYC. Cleaner Data. Ready-to-Disburse in Minutes.

Our Product Stack

- EMIs Collected Automatically. Cashflow Always Predictable.

- No Misses. No Follow-Ups. No Operational Load.

Our Product Stack

- One QR. All Payments. Zero Confusion.

- Scan. Pay. Track— Instantly and Accurately.

Enable MFIS/ NBFC field employee to collect EMIs digitally via QR or in cash, with secure deposits at nearby CMS-enabled locations for faster reconciliation.

Our Product Stack

- From cash leakages to trackable digital collections

- Lower collection costs, increase repayment efficiency.

- Reduce fraud risk with verified collections.

Our Product Stack

- Customers Pay Anytime. You Get Paid Instantly.

- Frictionless Self-Pay. Zero Touch. Zero Delay.

Our Product Stack

- Field Collections Streamlined. Every Payment Accounted.

- Real-Time Collections. Zero Manual Chase.

Our Product Stack

- Retailer Pays Direct. You Get Paid Faster.

- Direct Collections. No Middle Layers. No Delays.

- Cleared Dues. Clean Cashflows. Complete Control.

Our Product Stack

- Daily Reconciliation, Done. Clean Books in Minutes.

- Every Rupee Tracked. Every Transaction Matched.

- Zero Reco Stress. Full Ledger Transparency.

Customers can withdraw or deposit cash using Aadhaar-linked bank accounts. Ideal for rural banking and last-mile financial inclusion.

- Plug In. Fast Integration. Go Live with Higher Commission

- Zero Downtime. 100 % transaction processing rate

- Built for Scale, Speed & Stability

Our Product Stack

- Plug In Aadhaar Pay. Start Accepting Payments Instantly

- No Cards. No Cash. No Smartphone Required

- Zero Declines. Faster Checkouts. Higher Merchant Earnings

Our Product Stack

- Turn Any Shop Into a Mini ATM with Fingpay SDK Solutions

- Reliable Withdrawals. Quick Processing. Zero Failures

- Built for Bharat’s Last-Mile Cash Needs

- Swipe, Tap, or Scan — Accept Every Payment Instantly

- Zero Downtime. Fast, Secure & Seamless Transactions

- Built for Scale, Speed & Smarter Merchant Payments

Our Product Stack

- Unified Payments. Unified Data. Zero Integration Friction.

- Plug In Once. Sync Everything. Operate at Enterprise Speed.

Our Product Stack

- Every Payment Auto-Matched. Every Ledger Always Clean.

- Virtual Accounts That Reconcile Themselves—Daily, Instantly, accurately.

Our Product Stack

- Swipe, Tap, or Scan — Accept Every Payment Instantly

- Zero Downtime. Fast, Secure & Seamless Transactions

- Built for Scale, Speed & Smarter Merchant Payments

Our Product Stack

- Plug In solutions to add value in services offering

- One Platform, multiple benefits

Our Financial API Solutions

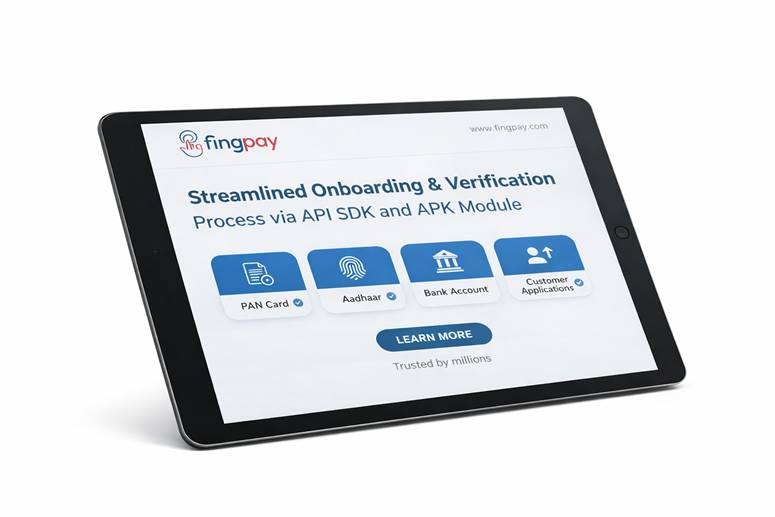

Accelerate your customer acquisition with Fingpay’s digital KYC and verification APIs — built

for NBFCs, MFIs, Fintechs, Banks, Corporates Partner

Customer Application Suite

Manage the entire end-to-end customer journey — from onboarding to verification, document collection, and approval — all within a single workflow.

PAN Verification API

Instant validation of PAN details from NSDL databases ensuring compliance & fraud prevention.

Aadhaar Verification API

Seamless Aadhaar authentication (via biometric, OTP, or XML) for paperless onboarding.

Voter ID Verification API

Verify voter ID credentials instantly through official electoral data sources.

Bank Account Verification API

Enable real-time bank account verification using penny-less or penny-drop mechanisms.

Fingpay’s unified Payment APIs enable seamless UPI, AadhaarPay, POS, and online transactions

with flexible integration and MDR-based revenue.

BHIM UPI

Integrated UPI acquiring and merchant QR solution supporting intent, static, and dynamic flows.

BHIM AadhaarPay

Accept payments directly from customers’ Aadhaar-linked bank accounts with biometric authentication.

POS (mPOS)

Accept seamless in-person payments using credit and debit cards through secure and portable mPOS devices.

Payment Gateway

Enable fast and secure online payments across UPI, cards, net banking, and wallets via a single integration.

BBPS

Offer a unified platform for secure and instant payment of utility and recurring bills under the BBPS ecosystem.

Fingpay’s unified API and SDK suite empowers partners to seamlessly integrate AEPS, CMS, and Micro

ATM services into their platforms to enabling instant access to last-mile banking.

CMS Services

End-to-end cash management & collection services for corporates, MFI’s and NBFC partners.

AEPS – Aadhaar Enabled Payment System

Seamless Aadhaar-based cash withdrawals, deposits, and balance inquiries ensuring financial access for all.

Micro ATM

Instant cash withdrawal, balance inquiry & fund transfer through our Fingpay-powered micro-ATMs deployed.

What our Partners say

Trusted by Leading Financial Institutions across India

“Fingpay has revolutionized our approach to digital collections. Their innovative solutions and dedicated support have been instrumental in our growth.”

Vivek Tiwari

Amitesh Kumar

“In order to become a world-class role model microfinance institution, Midland Microfin Limited always intended to be compliant-oriented, adopting proactive risk mitigation strategies, and always endeavors to bring innovation to the business model of the company. In line with the same philosophy, Midland Microfin Limited has collaborated with “Fingpay” for using their Cash Management Solutions for depositing repayment cash at the field level. They have a robust network of CMS points at the rural level and a reconciliation system which helps us a lot. Fingpay has given us great satisfaction always through their support and services at the ground level. I hope to continue the cooperation many times over.

Aastha Gupta

“As a satisfied customer, I can confidently say that Fingpay has revolutionized our approach to cashless collections.The platform’s reliability and ease of use have significantly boosted our operational efficiency, reducing the dependency on cash handling and ensuring a smooth flow of payments. Fingpay’s innovative technology has empowered us to serve our customers better, especially in remote areas where digital payment accessibility was a challenge. It has truly made a great impact on how we collect payments, paving the way for a more inclusive and cashless future. Kudos to the Fingpay team for their exceptional product and service!

Svatantra Microfin Private Limited

“We have been working with Fingpay since 2018, and it has been an incredibly positive experience. Their EMI Collection services, Cash Management, and Digital Payments solutions have consistently met our business needs and exceeded our expectations. Over the years, we’ve seen continuous improvements and product enhancements, which have played a significant role in streamlining our operations and ensuring seamless financial transactions.

Media Insights

Inspiring Leadership Exchange at AIMA YLC 2024

Knowledge Exchange on the Future of Microlending

Fingpay was honored to be part of “Re-imaging Microlending: Emerging Technological Trends and Innovations”, an interactive breakaway session that explored the innovations in the microfinance sector, and how these transformative steps are aided by technological advancement.

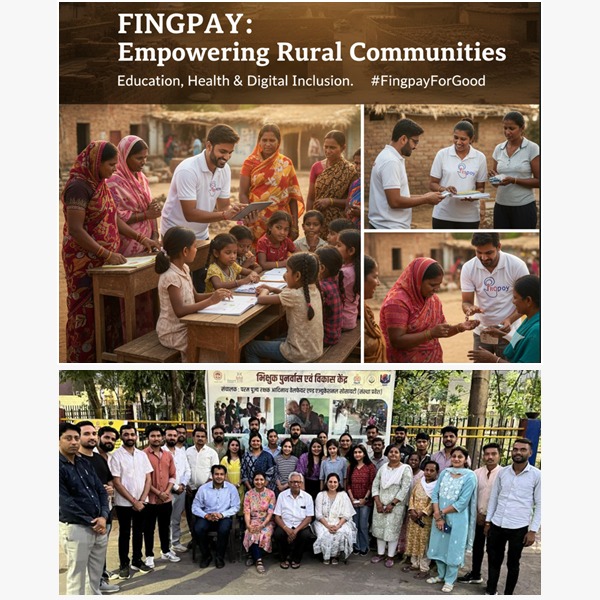

Ground Engagement with Community Partners

At #Fingpay, staying connected to the #communities we serve isn’t just a priority—it’s the #foundation of what we do. Fingpay has a recent field visit to Samasta centre.

Welcoming Ms. Purvi Bhavsar at Our Indore Office

We were delighted to host Ms. Purvi Bhavsar, Co-founder and MD of Pahal Financial Services Pvt. Ltd., at our Indore office.

Fintech Meetup with Abhishant Pant at Fingpay

Fingpay had the honor to have a Fintech Meetup with industry expert Abhishant Pant at its office at Indore (M.P.)

Reinventing Business Models: A Panel Discussion

Panel Discussion on Entering New Frontiers and Reinventing Existing Models. #IvyCapDay2024 #Fintech #Innovation #Leadership #Payments #VentureCapital #TheCatalystEffect

About Fingpay

"Connecting every transaction - From People to Business

Our Vision

“To Redefine the future of Payments by becoming the most trusted partner for businesses Globally..”

Our Mission

“To build reliable, scalable, and secure payment infrastructure that connects people, businesses, and institutions via technology.”

Backed by ICICI Bank & IvyCap Ventures, Fingpay is India’s leading B2B fintech platform, empowering businesses with secure, inclusive, and scalable payment solutions since 2016.

Banking Solutions

AEPS, UPI, mATM & mPOS services

Payment Infrastructure

Secure API & SDK integrations

Financial Services

Digital lending & collections

Our Banking Partners

our investor

1M+

Merchants

USD 9+ Bn

Transactions Processed

40+

Enterprise Clients

Pan-India

Urban, Rural & Remote Markets

Meet the minds behind Fingpay

Pratyush Halen

Pratyush Halen is the CEO and Co-founder of Tapits Technologies, driving digital and financial inclusion through scalable fintech solutions. With a background in computer science, he brings strong execution focus across banking partnerships and technology-led growth.

Pratyush Halen is the CEO and Co-founder of Tapits Technologies, driving digital and financial inclusion through scalable fintech solutions. With a background in computer science, he brings strong execution focus across banking partnerships and technology-led growth.

Anurag Agrawal

27 Years of Experience

Anuraag Agrawal is the Co-founder of Fingpay and a technology leader in Rural Banking and Digital Payments. A holder of four US patents and built scalable products and high-performing engineering teams.

Anuraag Agrawal is the Co-founder of Fingpay and a technology leader in Rural Banking and Digital Payments. A holder of four US patents and built scalable products and high-performing engineering teams.

27 Years of Experience

Vikram Gupta

27 Years of Experience

Vikram Gupta is the Founder and Managing Partner of IvyCap Ventures, a venture capital firm focused on backing professional entrepreneurs. He brings deep expertise in venture investing, value creation, and strategic exits

Vikram Gupta is the Founder and Managing Partner of IvyCap Ventures, a venture capital firm focused on backing professional entrepreneurs. He brings deep expertise in venture investing, value creation, and strategic exits

27 Years of Experience

Rahul Joshi

Ivycap Ventures

Rahul Joshi has 30+ years of hands-on experience in Retail Banking, Payments, and FinTech. He led ICICI Bank’s landmark digital initiatives, including iMobile and branchless banking, and was a chief architect of IMPS and UPI, contributing significantly to India’s digital payments infrastructure.

Rahul Joshi has 30+ years of hands-on experience in Retail Banking, Payments, and FinTech. He led ICICI Bank’s landmark digital initiatives, including iMobile and branchless banking, and was a chief architect of IMPS and UPI, contributing significantly to India’s digital payments infrastructure.

Ivycap Ventures

Want to be a part of this

Exciting Journey?

Want to Experience Seamless Payments?

<2secs

Transaction Processing speed

<99.99%

Success Rates

Customizable solutions

RBI-NPCI Compliant & Regulated PCI-DSS & ISO

<0

Latency/ Downtime

Our Investors

Want to be part of Fingpay & create impact?

Be part of a dynamic fintech team & believes at full individual ownership and shaping the future of digital payments.

Life at Fingpay

Investors

Want to be Support & create impact?

CSR Partners Associated So far